Condotel And Non-Warrantable Condo Loans

This BLOG On Condotel And Non-Warrantable Condo Loans Was UPDATED On And PUBLISHED On February 23rd, 2020

Non-Warrantable Condos are condominiums that belong to a condominium complex where 51% or more of the units are owned by investors.

- A non-warrantable condominium is a regular condominium in a condo complex but 51% or more of the unit owners are non-occupant unit owners

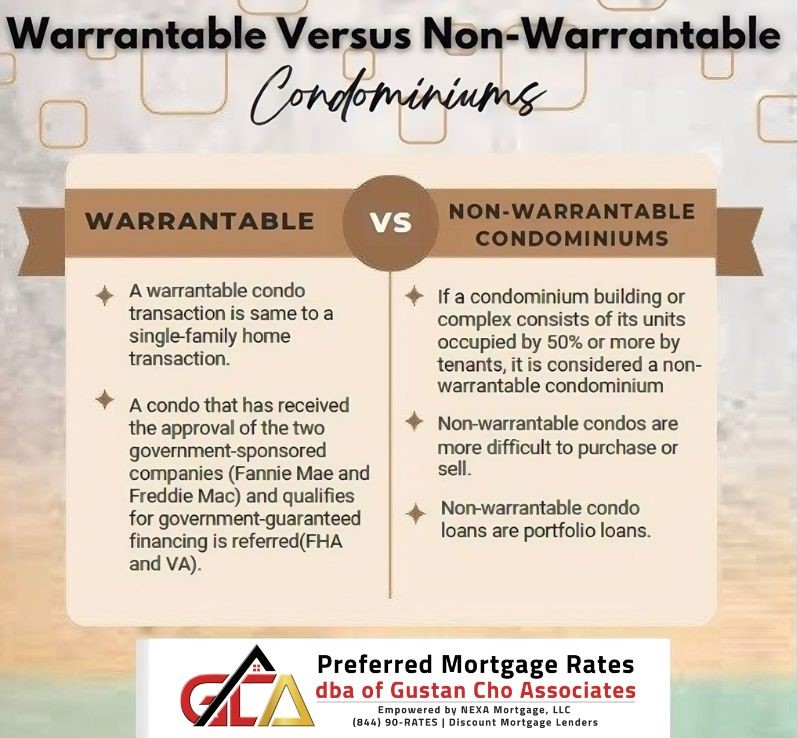

- Fannie Mae and/or Freddie Mac will not purchase any loans from a non-warrantable condo complex

- A warrantable condominium complex can become a non-warrantable condo

- On the flip side, a non-warrantable condo can become a warrantable condo depending on the 51% rule

In this article, we will discuss and cover condotel versus non-warrantable condo financing guidelines.

Warrantable Versus Non-Warrantable Condominiums

- If a condominium building or complex consists of its units occupied by 50% or more by tenants, it is considered a non-warrantable condominium

- Non-warrantable condo loans are portfolio loans

- Portfolio loans are mortgages that are held by the lender in their investment portfolio

- Portfolio loans are not sold to the secondary market like conforming loans

Non-Warrantable Condo Loans Very Popular

Non-warrantable condo loans are becoming more popular than ever, especially in Florida, California, and Illinois.

- Second-home buyers like the fact that they can purchase a non-warrantable condominium and condotel units by the ocean

- The like to occupy it several months out of the year and be able to rent it out when they are not using it

- Many non-warrantable condominium owners hire a property management company to manage their non-warrantable condos

- Using it personally as well as renting it while it is not in use by the homeowner offers great benefits

Most non-warrantable condo property managers take a percentage of the rental income as their fees.

Non-Warrantable Condos And Condotels As Investment Properties

A large percentage of condotel and non-warrantable condo homeowners rent their condos on a short term basis to maximize the income. A condotel is a condominium unit in a hotel complex. Both condotels and non-warrantable condos can be used as primary homes, second homes, and investment income-producing properties.

-

- They might charge $1,000 for a week rental to a tourist versus a $1,000 per month to a long term tenant.

- Other lease programs include weekend rentals, monthly rentals, quarterly rentals, and semi annual rentals

- Other homeowners just occupy their non-warrantable condos as their primary residences

Mortgage Rates and Terms on Non-Warrantable Condo And Condotel Financing

Non-warrantable condo loans mortgage rates are slightly higher than a warrantable condo mortgage loans.

- Most non-warrantable condominium loans are adjustable rate mortgages, 7/1 ARM. 5/1 ARM, 3/1 ARM

- Most portfolio loans are adjustable rate mortgages

- This holds true since lenders do not want the risk of being obligated to an interest rate for 30 years

- This is since they are holding the mortgage in their investment portfolio

- Borrowers need a minimum of 680 credit scores

- 25% down payment is required on condotel financing

- 20% down payment is required on non-warrantable condo financing

- The minimum loan amount is $100,000 and no maximum loan amounts

- Minimum condo size is 500 square feet

- Condotels and Non-Warrantable condos need to have at least one bedroom and a fully functional kitchen

Condotel and/or Non-Warrantable Condominium buyers interested in non-warrantable condo loans or condotel financing can call us at Gustan Cho Associates at 800-900-8569 or text us for faster response. Or email us at gcho@gustancho.com.