Multi-Family Non-Occupant Co-Borrower Guidelines

In this blog, we will cover and discuss non-occupant co-borrower guidelines in two to four unit homes. Multi-Family Mortgage Guidelines are different depending on the individual loan program. Multi-Family Non-Occupant Co-Borrower Guidelines are also different when adding non-occupant co-borrowers to a 2 to 4 unit home purchase. Any two to four-unit property zoned residential can qualify for owner-occupant properties as long as one of the units is an owner-occupant. One of the great advantages of buying a multi-family home is the owner can live in one of the units and rent out the remaining units. Down payment requirements vary depending on the loan program on Multi-Family Mortgage Loans. In this blog, we will discuss Multi-Family Mortgage and Multi-Family Non-Occupant Co-Borrower Guidelines on government and conventional loans.

Multi-Family Mortgage Guidelines On Owner-Occupant Homes

Multi-Family Mortgage Down Payment Guidelines on FHA Loans is 3.5%. 2 to 4 unit home buyers who intend to live in one of the units as a primary residence can qualify to purchase a multi-family home with a 3.5% down payment. Freddie Mac Home Possible mortgage program allows 2 to 4 unit home buyers to qualify with a 5% down payment with conventional loans. Fannie Mae’s conventional guidelines require a 15% down payment on 2 units and 25% on 2 to 4 units on conventional loans. Cash-out refinance mortgages are allowed on 2 to 4 unit properties. The maximum loan to value on 2 to 4 unit cash-out refinance mortgages is capped at 75% LTV

Freddie Mac Guidelines On 2 To 4 Unit Homes

Freddie Mac Mortgage Guidelines on 2 to 4 unit conventional loans are the following:

- 15% down payment on 2 units

- 20% down payment on 3 to 4 units

- The maximum loan to value on cash-out 2 to 4 multi-family mortgages is capped at 75%

Multi-Family Mortgage Guidelines on Investment Properties

Investment properties on Multi-Family Mortgage Loans have their own lending requirements when it comes to the down payment. The loan-to-value requirement for Freddie Mac’s 2 to 4 unit investment homes is 75% LTV to finance with conventional loans. Multi-Family Properties require reserves. The amount of reserves depends on the type of multi-family unit as well as the loan program

Down Payment Requirements on Multi-Family Homes

To recap, HUD allows non-occupant co-borrowers. The down payment is 3.5% on single-family homes. The 3.5% down payment also includes adding non-occupant co-borrowers. Alex Carlucci is a senior vice president with Gustan Cho Associates and an expert on multi-family financing. Here is what he has to say about multi-family non-occupant co-borrower guidelines:

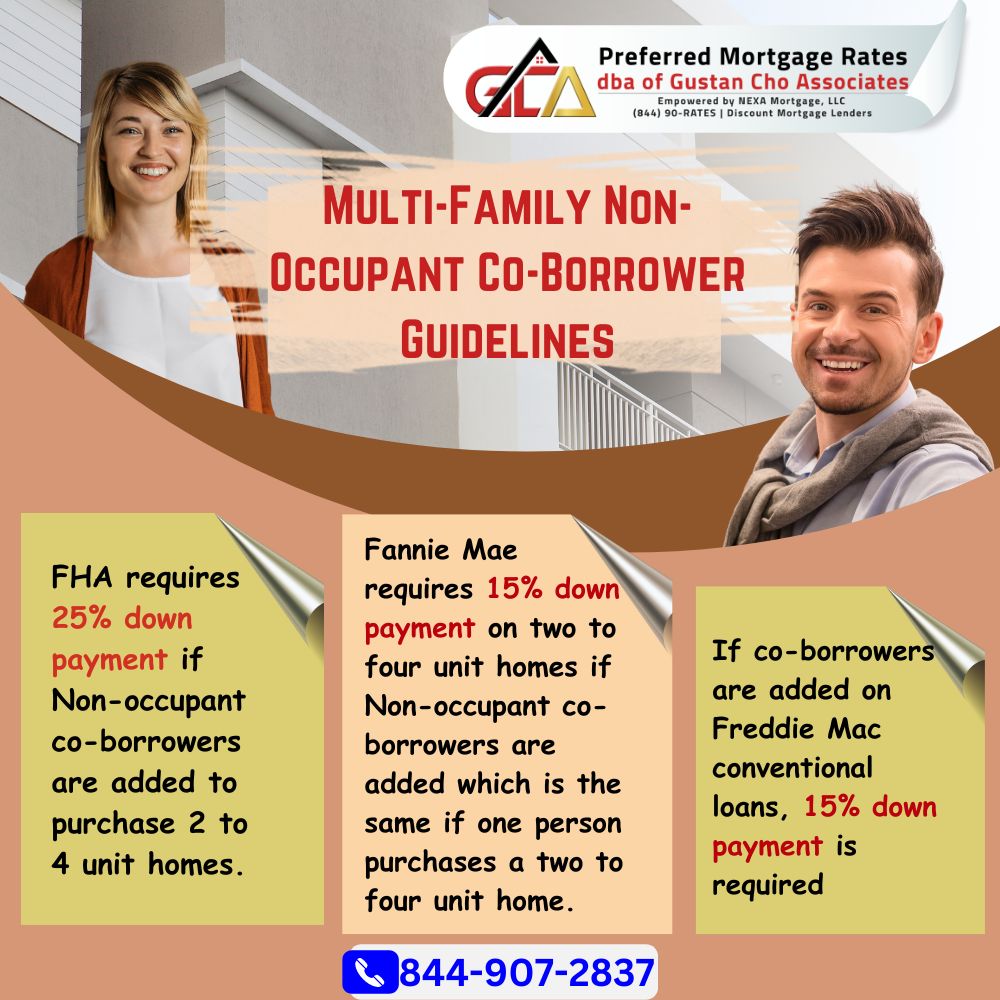

To qualify for a 3.5% down payment FHA Loan on single-family homes, the non-occupant co-borrowers need to be related to the main borrower by blood, marriage, or law. Otherwise, FHA requires 25% down payment. However, on 2 to 4 unit multi-family homes, FHA requires 25% down payment if Non-occupant co-borrowers are added to purchase 2 to 4 unit homes. Fannie Mae requires 15% down payment on two to four unit homes if Non-occupant co-borrowers are added which is the same if one person purchases a two to four unit home. Freddie Mac HomePossible requires 5% down payment on two to four unit multi-family homes. If co-borrowers are added on Freddie Mac conventional loans, 15% down payment is required

However, 3% out of the 5% of the down payment needs to come from the main borrower.

This BLOG On Multi-Family Non-Occupant Co-Borrower Guidelines Was PUBLISHED On July 12th, 2022