Bank Statement Mortgage Loans

Bank statement mortgage loans are the mortgage loan option of choice for self-employed borrowers. Bank statement mortgage loans is one type of non-QM loan. Non-QM loans are portfolio loans which means the lender normally holds the loan in-house. Most self-employed homebuyers often do not show sufficient adjusted gross income on their tax returns. This is due to the tax benefits business owners get with unreimbursed business expenses. Many self-employed borrowers may even show negative income or loss on their income tax returns. Now, with bank statement mortgage loans, self-employed homebuyers do not have to provide income tax returns.

Mortgage lenders will average the past 12 months of bank statement deposits and use the average as the monthly qualified income. Depending on the lender, some lenders will only use a percentage of the deposit while other lenders will average the whole monthly deposit. In this guide on bank statement mortgage loans, we will cover what bank statement mortgage loans are and how they work.

What Are Bank Statement Mortgage Loans?

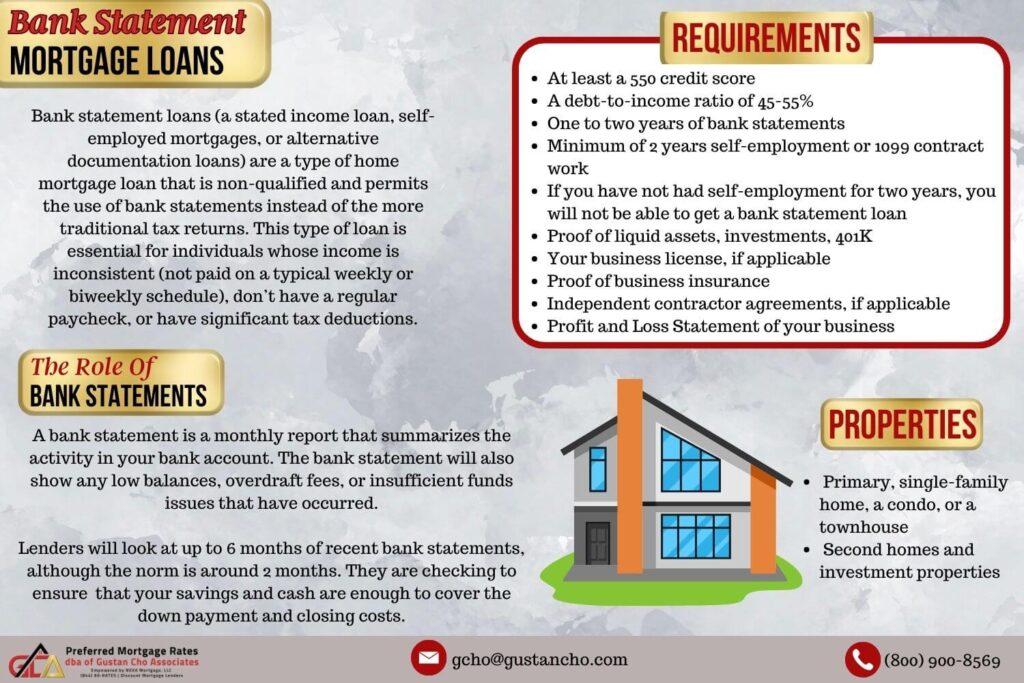

Bank statement loans (a stated income loan, self-employed mortgages, or alternative documentation loans) are a type of home mortgage loan that is non-qualified and permits the use of bank statements instead of the more traditional tax returns. This type of loan is essential for individuals whose income is inconsistent (not paid on a typical weekly or biweekly schedule), don’t have a regular paycheck, or have significant tax deductions. These individuals are typically self-employed or work as business owners, lawyers, real estate agents, or perhaps medical professionals. These types of individuals are often independent contractors or perhaps freelance writers. A retiree might also seek out this type of loan.

How Do Bank Statement Mortgage Loans Work?

A bank statement loan allows borrowers with a certain amount of income. Income is based on the monthly deposit on bank statements. The amount of income claimed on their tax returns does not count. The borrower’s income tax returns do not have to be provided to the lender. In reality, self-employed borrowers have more net income than they have made. They are using the income tax loophole not to declare all the money they have actually made. These loans often have high loan limits.

Mortgage Rates on Bank Statement Mortgage Loans

A bank statement loan often has higher interest rates. Bank statement mortgage loans are available on primary, second homes, and investment properties. There are lenders who may charge a pre-payment penalty for an early payoff on investment properties bank statement mortgage loans. A pre-payment payoff penalty is if you paid the loan off early or refinance. However, this is not always the case. Often, you can borrow up to 80% of the home’s value, more if you have financial reserves and appropriate credit.

What Type of Properties Can You Purchase With Bank Statement Mortgage Loans

You can use a bank statement loan to purchase a primary, single-family home, a condo, or a townhouse. You can also use this loan type to buy second homes and investment properties, which is not allowed with some other specialty-type loans, such as the VA or USDA loans. A potential buyer should first find out if they are able to qualify for a traditional loan. If they do not qualify due to the fact that they do not have pay stubs, W2s, and other conventional documents that do not reflect their actual income, the bank statement loan is an option.

What Is A Non-Qualified Mortgage?

One of the common frequently asked questions we get at GCA Mortgage Group is what is a non-qualified mortgage. If you think you qualify for a bank statement loan, you will need to know what a non-qualified mortgage is. A non-qualified mortgage (non-QM) is simply a loan that is designed to help potential buyers who do not meet the traditional and stringent criteria for qualifying. However, you will still be required to meet other standards and demonstrate proof that you have the income and means to pay off a mortgage loan.

Applying For For Bank Statement Mortgage Loans

The process of applying for bank statement mortgage loans is different from conventional loans. The lender will often want to see documents from a more extended period, such as two years of bank statements. If you have both personal and business accounts, the lender will want to see all your bank statements. The lender will often need to know what type of business you own if there is a physical address and the number of employees you have. This information helps lenders decide on risk. They want to know that your business has financial security.

What Documents Do I Need To Provide To Get Qualified For Bank Statement Loans?

As with all home mortgage loan programs, borrowers need to complete a mortgage loan application. The loan officer assigned to the borrower will interview the borrower and run the borrower’s credit. The loan officer will review the tri-merger credit report and make sure there will be no hiccups throughout the non-QM mortgage loan programs. Once everything is a go, the loan officer and the mortgage processor will request documents so they can proceed with the pre-approval process. Below we will list the basic eligibility requirements for bank statement mortgage loans and examples of documents or things that different lenders will require.

- At least a 550 credit score.

- A debt-to-income ratio of up to 45-55 %

- One year to 2 years of bank statements

- Minimum of 2 years self-employment or 1099 contract work.

- If you have not had self-employment for two years, you will not be able to get a bank statement loan.

- Proof of liquid assets, investments, 401K

- Your business license, if applicable.

- Proof of business insurance

- Independent contractor agreements, if applicable.

- Profit and Loss statement of your business

Bank Statement Mortgage Loans Credit Guidelines

Credit also plays into the mix, just as with a traditional loan. Before applying for a loan, you must look at your credit health. Individuals might be under the impression that if they check their own credit score, it will affect them negatively. This is not true. If you check your own credit, this is called a soft inquiry. This does not change your score. However, if you have a hard inquiry, say if you apply for a credit card or car loan, this will show up on your credit. This can stay on your credit report for two years! Issues can arise on your credit report without many people’s knowledge. You want to ensure that you have made payments on time. There is often a “grace” period when payments are due. This is not always the case and is individual to each institution. People sometimes do not figure this out until they check their credit reports.

What Do Lenders Look For On Bank Statements?

You also want to check for suspicious activity on your report, which might signal identity theft. You are able to dispute any incorrect statements on your report through the credit reporting bureau; however, this can take months to resolve. You do not want to find out about these dings on your credit when the lending institution checks, and it is often too late at that point. Your credit score can often change, sometimes even daily. If you have used a credit card for purchases, it can change your score. Sometimes, all it takes is a payment on your credit card to reverse the change.

Credit Score Requirements on Bank Statement Mortgage Loans

Every non-QM mortgage lender has its own credit score requirements on bank statement mortgage loans. In general, most non-QM lenders will want to see at least a 550 FICO score on bank statement mortgage loans. However, GCA Mortgage Group has wholesale lending partners that will go down to 500 credit score on bank statement mortgage loans.

Bank Statement Mortgage Loans With Credit Scores Down To 550 FICO

Most lenders are looking for a credit score of 700 or higher, but generally, you can qualify with a 620 at a decent rate on bank statement mortgage loans. You can qualify for non-QM loans with credit scores down to 550 FICO. Borrowers with under 620 credit scores may be required to pay discount points and a higher down payment on bank statement mortgage loans. Remember that the lower your credit score, the more you might be required to put down, which will impact your interest rate.

Debt to Income Ratio Requirements on Bank Statement Mortgage Loans

A debt to income ratio (DTI) is a term used by lenders to describe an individual’s debt (what is owed each month) vs. what they earn each month. This allows lenders to see how much of a loan you can afford. There are two different types of DTI ratios. There is the front end and back end DTI.

Front end ratio considers the amount of gross income that goes toward housing costs. Back-end ratios calculate the gross income that goes toward ALL monthly debts. This includes credit card payments, housing costs, car payments, etc. Although all lenders will check this ratio when you apply for a mortgage, it may vary when applying for a bank statement loan.

Documents Required To Get Started on the Non-QM Bank Statement Loan Process

Some examples of documents or things that different lenders will require:

- At least a 550 credit score

- A debt-to-income ratio of up to 45-55 %

- One year to 2 years of bank statements

- Minimum of 2 years self-employment of 1099 contract work

- Proof of liquid assets, investments, 401K

- Your business license, if applicable

- Profit and Loss statement

What Do Mortgage Underwriters In Bank Statements To Calculate Income

A bank statement is a monthly report that summarizes the activity in your bank account. People receive bank statements on all their accounts, but it can vary on how you get them. Some individuals still like to receive paper statements, some like to go paperless and get electronic statements, and some get both! A bank statement will show all deposits and withdrawals from the accounts, including ATM withdrawals or deposits.

Red Flags In Bank Statements Mortgage Underwriters Look For

The bank statement will also show any low balances, overdraft fees, or insufficient funds issues that have occurred. Due to the fact that your bank statements are what are used to verify income and ensure you can afford the cost associated with a bank statement mortgage, there are some tips to follow to make sure that the bank statement review does not hold up the process. Lenders will look at up to 6 months of recent bank statements, although the norm is around two months. They are checking to ensure that your savings and cash are enough to cover the down payment and closing costs.

What Is Considered Sourced Assets By Lenders?

Specifically, an underwriter will look to see if your cash is sourced and seasoned. Sourced cash refers to ensuring that it’s clear where the money came from. Seasoned cash is when the money has been in your account for longer than a month, typically 60 days. Lenders want to see that you have enough cash flow to support the mortgage loan repayment. They are also checking to see if you have recently taken on more financial debt, as this will impact your debt-to-income ratio.

Bank Overdrafts During The Mortgage Process

Bank overdrafts are considered very bad by many mortgage underwriters. Lenders will assume if you have bank overdrafts, you are financially irresponsible. Many non-QM lenders will automatically disqualify you if you have had any bank overdrafts in the past 12 months. However, bank overdraft is not always a deal killer.

Can You Qualify For Bank Statement Mortgage Loans With Overdrafts?

GCA Mortgage Group has over 190 wholesale lending partners. Many of our wholesale lending investors can overlook bank overdrafts with a good letter of explanation. Mortgage underwriters do not want to see bounce checks and overdraft fees for non-sufficient funds. This will red flag lenders as it shows that you are perhaps not proficient at money management or that you are living paycheck to paycheck, barely making it.

How Regular Monthly Payments Can Trigger Questions by The Mortgage Underwriter

You will want to see if there are any payments that have come out of your bank that is not disclosed on your application. This would be a payment that wouldn’t be shown on your regular credit report. If you have an automatic payment that comes out every month, perhaps a personal loan from a wealthy family member, it wouldn’t show up on your credit report. However, it will show up on your bank statements.

How Do Mortgage Underwriters Verify Bank Statements?

When they are checking your statements, they will look to see if there are gaps in your income history. There are potential reasons for this, such as seasonal work. If this is the case, they will want to see that you have proper money reserved for the times when you do not have active income.

Do Mortgage Underwriters Look For At What You Spend Money On?

Another issue that an underwriter will look for on your bank statements is potential money laundering. Money laundering is the process of making illegal income. They are looking for anything suspicious, either deposits or withdrawals. Lenders will look to see if there appears to be action taken to conceal illegal income. The typical person is not entangled in money laundering, but there are red flags that can show up on your bank statements that make it appear suspicious.

How Mortgage Underwriters View Large and Irregular Deposits in Your Bank Statements

If you have recently had a large deposit made into your account, a lender will want to know where it came from and why. This is particularly true if you have “gifted deposits”, which are financial gifts from family and friends. If this has been the case, it can usually be easily explained via a signed gift explanation letter. A letter of explanation should be kept short, and to the point, and provide supporting documents if you have them and necessary.

What Is Considered A Large and Irregular Deposit By The Mortgage Underwriter?

An example of a large deposit that was made with a logical explanation is, for example, if a person has recently sold their personal boat, and it shows up on their bank statement as a deposit for $20,000. The lender will want to see the proof that this large deposit was from the sale. This could be a copy of the check, a transfer in the title, etc. An inheritance or personal savings deposit is unusually accepted by lenders and should not create an issue. It is a good idea to start looking and thinking about what will show up on your bank statements well before applying for a mortgage loan.

What Are The Down Payment and Closing Costs on Non-QM Loans?

Bank statement loans will sometimes require a larger down payment as the lender considers these types of loans riskier. Mortgage lenders usually require a down payment, minimally of 3%, depending on what loan type you apply for. This is also the case for a bank statement loan. If you pay less than 20% down, you will need to pay for private mortgage insurance (PMI).

Finding The Best Mortgage Lender For Bank Statement Mortgage Loans

Many credit unions and banks offer bank statement loans. It is important to look around at different lenders as they have different requirements. Along with the varied requirements, you will also find that different lenders will offer different terms based on your credit score and your income. A mortgage broker would be able to assist you in navigating the wide range of options and obstacles out there. Lenders will give you many reasons why you should choose them and you need to be educated on why you should go with one over the other.

Non-QM Loans Versus Traditional Conforming Mortgages

In summary, the bank statement loan process is very similar to a traditional loan. However, the underwriting and type of documents required can be more extensive. Self-employment can be very difficult. Contractors, business owners, gig workers, and any individual who is self-employed deserve to have options available to them so that they can purchase the home of their dreams. More and more individuals are starting to work for themselves during the past decade, and it’s fitting that there are mortgage loans designed just for them.