Straw Buyer Purchasing Home For Family Members

Income, credit, and debt to income ratios are the three factors that determine a mortgage loan applicant’s potential whether they qualify for a mortgage loan.

- There are many other factors that need to be considered whether or not home buyers qualify for a loan

- There are mandatory waiting periods after a bankruptcy and foreclosure

- There are minimum credit score and debt to income ratio requirements

- Just because borrowers have little to no income, bad prior credit, or high debt to income ratios does not mean borrowers do not qualify for a mortgage

Straw Buyer In Home Purchase

A straw buyer is when two or more people conspire to get one person who has strong credit and income to purchase a home under their name. Straw Buyers come into play because the actual home buyer for the subject property does not qualify for a residential home loan.

- This practice is illegal and is classified as mortgage fraud which felony

- The federal government sees the use of straw buyers was one of the reasons for the real estate and mortgage meltdown of 2008

- They take cases of straw buyers extremely seriously

- However, many folks do not consider this a crime intentionally

- Many take it more like helping out a friend, relative, or family member to become homeowners

- There are many generous folks who help others

- Unfortunately, using their name to help a friend, relative, or family member qualify for and close on a home loan may cause some serious consequences for all parties

Lying On Mortgage Application

A typical straw buyer will lie on a mortgage application. They will state that the home will be an owner occupant primary residence when it is not.

- How can they apply for a second property purchase as a primary owner occupant home purchase?

- That can be done easy

- Here is a case scenario:

- If a homeowner currently owns a home

- Wants to purchase a second home as an owner occupant home

- Mortgage lenders will allow that if the case scenario makes sense

- If they can qualify for both mortgage loans in the debt to income ratio qualifications

- A homeowner who owns a 2,000 square feet home can tell their mortgage lender that their second property purchase is 30% larger than the current home

- They need a larger home due to their expanding family

- The 30% larger second property purchase will qualify as an owner occupant home

- On the flip side, the second property home buyer can state that they are moving to a much smaller home such as a condominium or a town home

- The move is due to being an empty nester

- The second property home purchase will qualify as a second home

- If the homeowner is moving from a 2,000 square feet home to another 2,000 square feet home 5 miles away

- This case scenario will not make sense

- Chances are that no matter what, the second property home purchase will not qualify as an owner occupant home purchase

- I am not condoning becoming a straw buyer but trying to deter it and relay the message of the seriousness of mortgage fraud and the consequences

- The risk versus rewards factors is really not worth it

- Federal regulators do crack hard on mortgage fraud cases

- This is the case even though the straw buyer has committed mortgage fraud with the best of intentions to help a friend, relative, or family member

There are alternatives besides being a straw buyer to help a loved one qualify for a home purchase will discuss the various options to go about it.

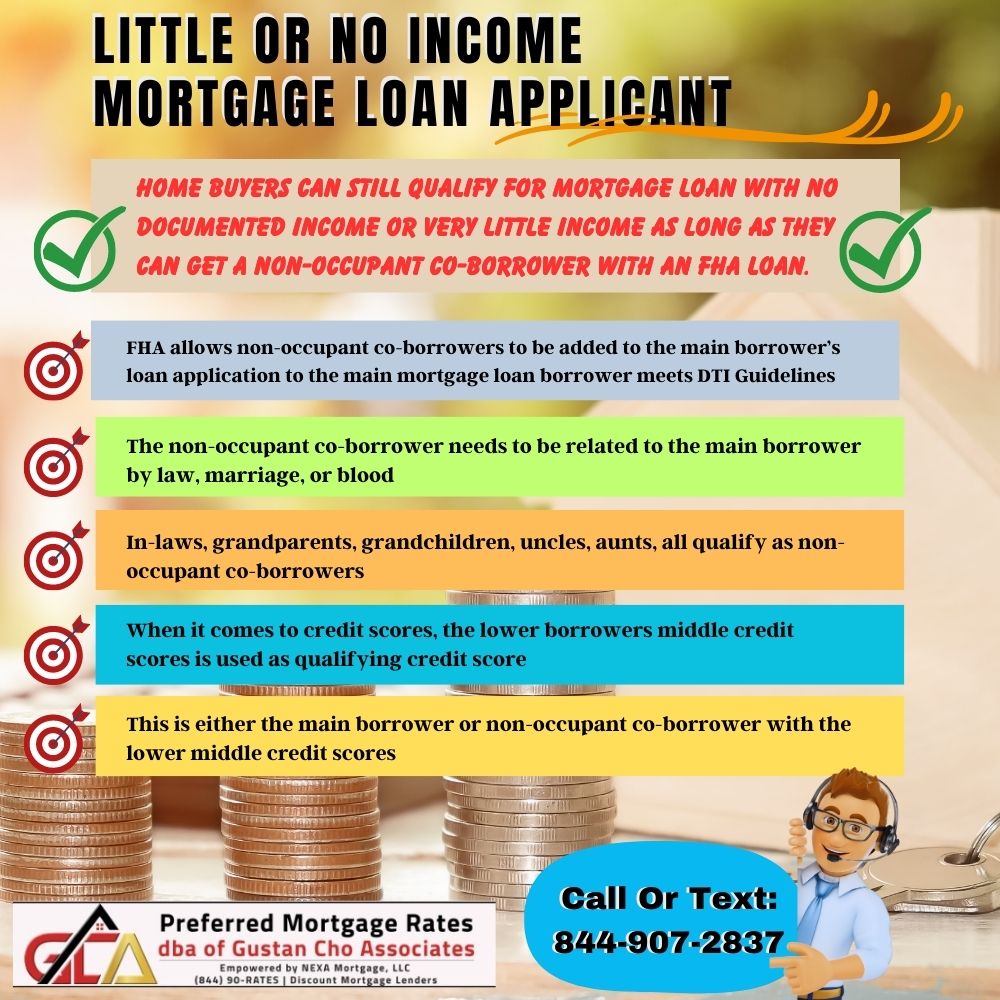

Little Or No Income Mortgage Loan Applicant

Home Buyers can still qualify for mortgage loan with no documented income or very little income as long as they can get a non-occupant co-borrower with an FHA loan.

- FHA allows non-occupant co-borrowers to be added on the main borrower’s loan application to the main mortgage loan borrower meets DTI Guidelines

- The non-occupant co-borrower needs to be related to the main borrower by law, marriage, or blood

- In-laws, grandparents, grandchildren, uncles, aunts, all qualify as non-occupant co-borrowers

- If someone is intending in being a straw buyer due to the main borrower not having income or very income, this option would be a great alternative than putting themselves at risk being a straw buyer for the individual

- When it comes to credit scores, the lower borrowers middle credit scores is used as qualifying credit score

- This is either the main borrower or non-occupant co-borrower with the lower middle credit scores

Home Loan With Bad Credit

A home buyer can qualify for a home loan with prior bad credit and open unsatisfied collection accounts without the collection accounts being paid off.

- Many buyers think that just because they were told they could not qualify with one lender that they cannot qualify with a different lender with no overlays

- A lender overlay is mortgage guidelines imposed on top of the minimum federal lending guidelines set by each individual lender

- The Gustan Cho Team has zero overlays on government and conventional loans

Minimum Credit Scores Required For FHA Loan

Minimum credit scores needed to qualify for a 3.5% down payment home purchase mortgage loan is 580.

- Borrowers can qualify with credit scores below 580

- However, a 10% down payment is required for borrowers with credit scores between 500 and 579

- Most banks and credit unions have their own overlays

- They will not accept borrowers unless the mortgage loan applicant has a minimum of a 640 credit score even though FHA only requires a 580

What If You Are Told By A Bank That You Need To Pay Off Collection Accounts With Balances?

Most banks and credit unions require borrowers to pay their outstanding collection accounts in order for them to be able to qualify for a loan with them:

- Paying off old collection accounts with credit balances is not a federal mortgage lending guidelines

- It is a mortgage lender overlay with that particular lender

- There are two types of collection accounts:

- Medical collection accounts

- Non-medical collection accounts

- Borrowers with large medical collection balance are exempt in debt to income ratio income qualifications

- For non-medical collections:

- 5% of the unpaid collection balance will be used towards debt to income ratio qualification on unpaid balance collection accounts that have balances of greater than $2,000

- Borrowers with large outstanding collection balances can get a written payment agreement with a minimum monthly promised payment agreement

- This will be used towards your debt to income qualification without any seasoning payment history requirements instead of the 5% of the outstanding balance

Many straw buyers believe that it is better to be a straw buyer than to pay off the outstanding collection account balances but this is not the case.

Waiting Period After Bankruptcy And Foreclosure

If the main home buyer had a recent bankruptcy and/or foreclosure, there is a mandatory waiting period after a bankruptcy, foreclosure, short sale, or deed in lieu of foreclosure in order to qualify for home loans:

- There is a two year mandatory waiting period after a bankruptcy in order for a home buyer to qualify for an FHA, VA, USDA Loans

- There is a 3 year mandatory waiting period after a foreclosure or deed in lieu of foreclosure from the recorded date of the deed in lieu of foreclosure in order to qualify for an FHA and USDA Loans

- There is a 3 year mandatory waiting period to qualify for FHA and USDA Loans from the settlement date reflected on the HUD after a short sale

- There is no way around this except that a home buyer can qualify non-qm loans

- Non-QM Loans does not have any waiting period requirements after housing event

- VA requires a two year waiting period after a housing event

Investment Home Mortgage Loan In Lieu Of Being A Straw Buyer

If the actual home buyer cannot qualify for a home after exploring all available options, the potential home buyer can see if they can qualify for an investment home mortgage loan and put the necessary 15% down payment and purchase the property as an investment property.