Home Loan Approval Process For Mortgage Borrowers

In this blog, we will discuss and cover the home loan approval process for mortgage borrowers. Most people dread the home loan approval process. The mortgage approval process is really not too bad as long as borrowers know what to face and expect. There is no reason why a pre-approved borrower should get a last-minute loan denial or stress during the home loan approval process.

The Importance of Qualifying Borrowers Prior To Issuing Pre-Approval Letter

Our pre-approvals at Gustan Cho Associates are full credit loan commitments signed off by our mortgage underwriters. Granted, the Home Loan Approval Process is not an easy process and can be frustrating. It is mainly because of all of the documents borrowers need to provide to their mortgage lender need to be complete. In this article, we will discuss and cover the Home Loan Approval Process For Mortgage Borrowers.

Documents Required To Process And Underwrite Home Loan

Example of documents required to process mortgage loan are the following:

- Two years tax returns

- Two years W-2s

- 12 months canceled checks for verification of rent

- 60 days bank statements

- Documents such as bankruptcy papers

- Foreclosure papers

- Divorce decree

- Child support paperwork

- Business tax returns if applicable, letters of explanations

- Other documents that mortgage lenders request

Stages Of Home Loan Approval Process

The home loan process has several stages. There is no reason why any mortgage borrower cannot close a mortgage loan in 30 days or less. There are several stages of the Home Loan Approval Process. There is no reason for any borrowers who have a solid pre-approval not to be able to close their mortgage loan on time. Also, there is no reason why any borrowers should stress over the mortgage approval process. This holds true as long as both the loan officer and borrowers can work together as a team and cooperate with the request of documents. The main reason for borrowers to get last-minute loan denials or stress during the mortgage process is because the loan officer did not properly qualify borrowers. Borrowers were not properly qualified and issued the pre-approval letter without proper due diligence.

Top Reasons For A Last-Minute Mortgage Denial

Here are the reasons for last-minute mortgage loan denials:

- The loan officer did not properly qualify the borrower

- The loan officer did not know mortgage guidelines

- The loan officer did not know about their company’s lender overlays

Stages In Mortgage Approval Process

The first stage in the mortgage approval process is the qualifying for a mortgage loan. The mortgage qualification process starts prior to borrower shopping for a new home. A pre-approval is needed by a real estate agent in order for the home buyer to be able to put a written offer on a property. A pre-approval is issued by a mortgage lender. The lender will take the borrower’s mortgage application, collect income and asset information, and run a credit check.

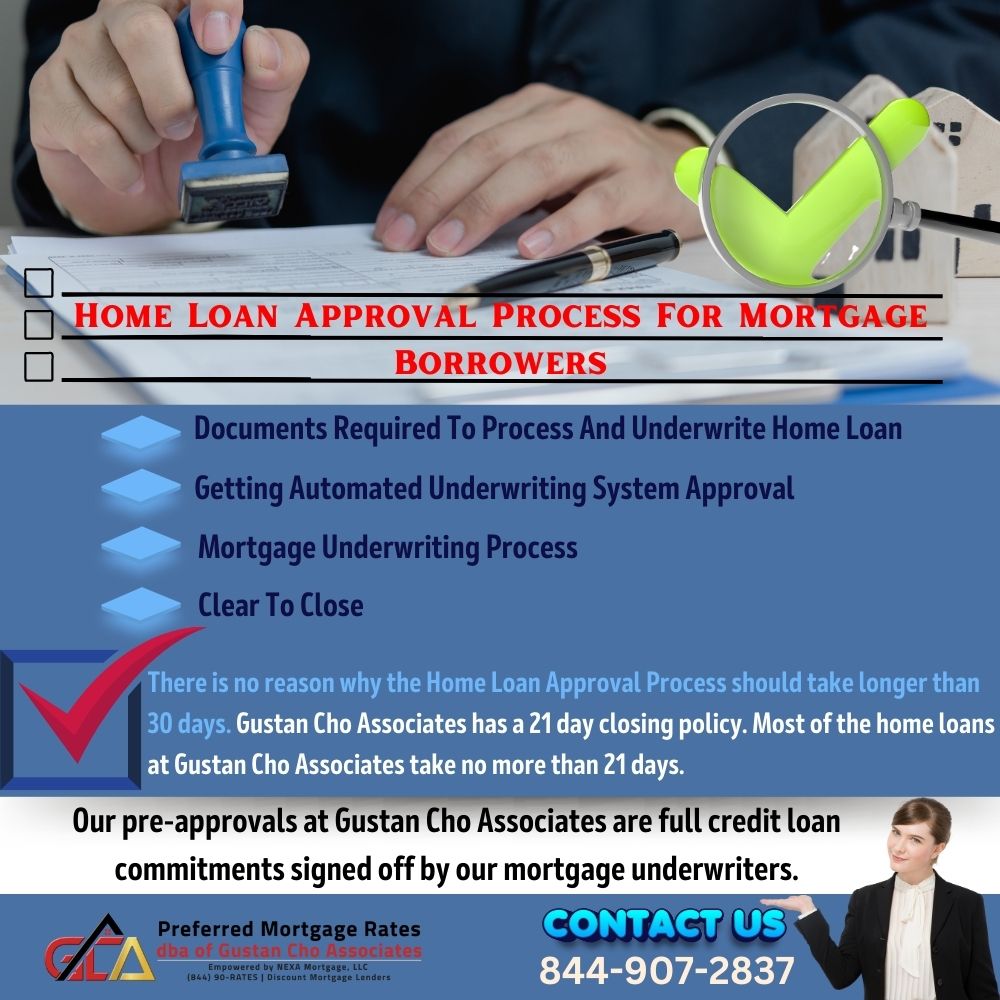

Getting Automated Underwriting System Approval

The lender will also run an Automated Underwriting System check for an automated approval by Fannie Mae. All pre-approvals should not be issued and signed by the loan officer. All of our pre-approvals at Gustan Cho Associates full credit loan commitments. They are issued by our mortgage underwriters and this is the reason we close 100% of all of our pre-approvals.

Documents Needed To Proceed With Mortgage Process

Once the home buyer gets a signed real estate purchase contract, he or she then submits it to the mortgage lender where the lender will prepare the official mortgage loan application along with the disclosures for signature from the mortgage loan borrower. The lender will require documents such as tax returns and other documents that need to be processed prior to going into underwriting.

Mortgage Underwriting Process

Once the mortgage application is processed, it gets submitted to underwriting. Within two days, the underwriter will decide on approval or denial. If approved, the appraisal is ordered and additional conditions would be requested such as verification of employment, update bank statements, updated paycheck stubs. Once the appraisal gets completed and the additional conditions are met, it goes through a final underwriting QC review and appraisal review.

Clear To Close

Once Quality Control signs off, a clear to close is issued. A clear to close means that the mortgage lender is ready to fund and disperse the loan. Closing arrangements are made and title changes hands when the mortgage lender wires the mortgage amount to the title company.

How Long Does The Home Loan Approval Process Take

There is no reason why the Home Loan Approval Process should take longer than 30 days. Gustan Cho Associates has a 21 day closing policy. Most of the home loans at Gustan Cho Associates take no more than 21 days. There are many mortgage companies that do not have any regards to borrowers and the closing date. There is no reason why a mortgage loan cannot close in 30 days or less and why any home closing needs to be delayed. All of our pre-approvals at Gustan Cho Associates are full credit approvals signed off by our underwriters. This is the reason why we close 100% of all of our pre-approvals. Borrowers who need a mortgage company with no overlays on government and conventional loans can email us at Gustan Cho Associates at gcho@gustancho.com or call us at 800-900-8569. Or text us for a faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.