Conventional Home Loans Mortgage Lending Guidelines

This BLOG On Conventional Home Loans Mortgage Lending Guidelines Was UPDATED On January 2nd, 2019

For those with higher credit scores and lower debt to income ratios, conventional home loans may be a better option than FHA loans.

- Both conventional home loans and FHA loans have advantages and disadvantages

- FHA loans are a better mortgage loan program for those who had a recent bankruptcy, foreclosure, or have a higher debt to income ratios

- A major disadvantage with FHA loans that the annual mortgage insurance premium of 0.85% can never be canceled on 30 year fixed rate mortgage loans

- The only way to get out of paying the annual mortgage insurance premium is to pay off the FHA loan

- With conventional loans, the private mortgage insurance premium depends on several factors such as credit scores, type of property, and loan to value

- Private mortgage insurance on conventional loans can be canceled once the loan to value of the subject home is at 80%

In this article, we will cover and discuss Conventional Home Loans Mortgage Lending Guidelines.

Guidelines For Conventional Loans

Conventional Home Loans are not government loans and are not guaranteed by the government. Conventional Loans need to meet Fannie Mae and/or Freddie Mac Guidelines in order for the lender to sell funded loans on the secondary market.

Here are the guidelines on conventional loans:

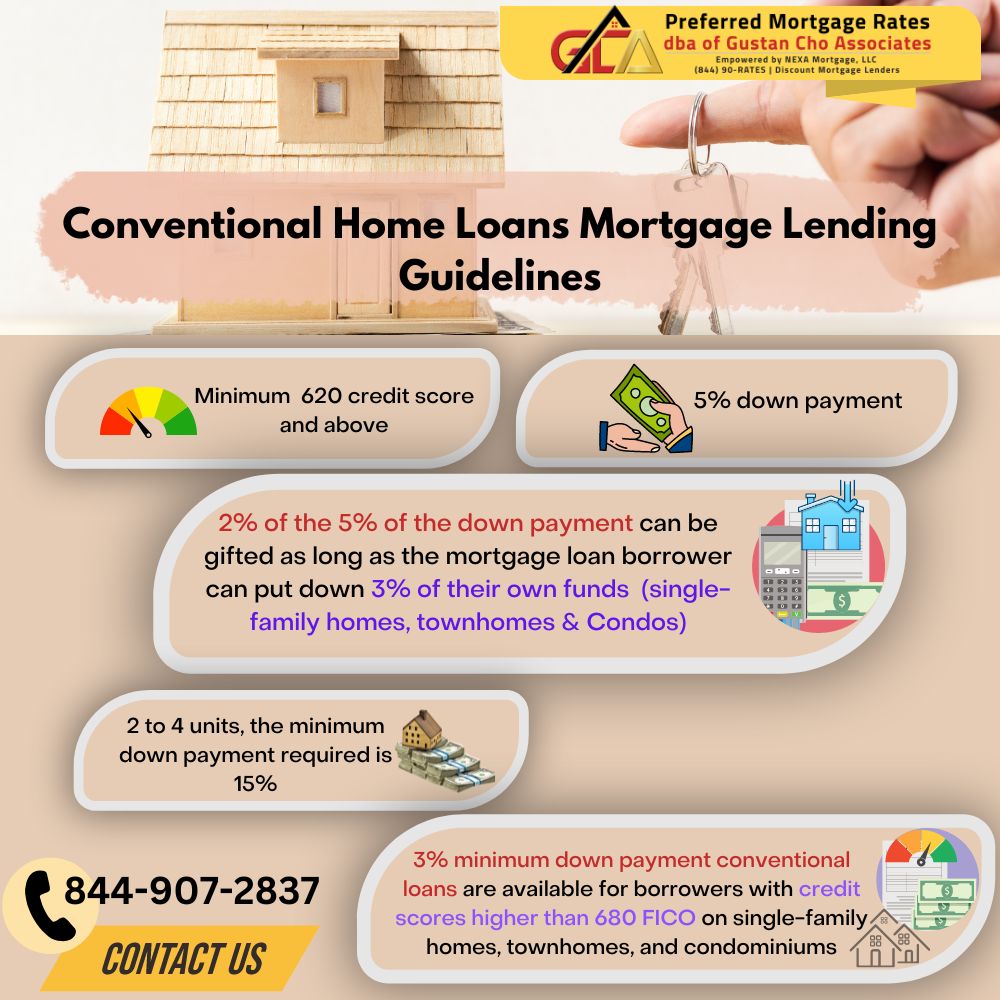

- Minimum 620 credit score and above

- However, the higher a borrower’s credit scores, the lower the mortgage rates

- Most banks and mortgage lenders max the back end debt to income ratios to 45%.

- We have conventional loan programs that will allow up to 50% Debt to Income ratios

- 5% down payment conventional loans available for those with a minimum credit score o 620 or higher

- 2% of the 5% of the down payment can be gifted as long as the mortgage loan borrower can put down 3% of their own funds (single-family homes, townhomes & Condos)

- 2 to 4 units, the minimum down payment required is 15%

- 3% minimum down payment conventional loans are available for borrowers with credit scores higher than 680 FICO on single-family homes, townhomes, and condominiums

- No condotels or non-warrantable condos

- Condotel Loans and non-warrantable condo portfolio loans are available as well

- No decs and bylaws required, minor litigation allowed on condos

- Borrowers Owning 5 -10 Financed Properties Accepted

- Delayed Financing…Borrowers purchased home for cash can do immediate cash-out refinance on Primary, NOO or 2nd homes

- Non-Permanent resident

Lender Paid Mortgage Insurance Conventional Loans

We offer conventional home loans that do not require the mortgage loan borrower to pay the private mortgage insurance premiums. For those who choose not to pay the private mortgage insurance premiums on 3% or 5% down payment conventional loans, the borrower needs to have a minimum credit score of 680 FICO and a debt ratio no higher than 45%. These unique conventional loans are called LPMI conventional loans. LPMI stands for Lender Paid Mortgage Insurance conventional loans.