Mortgage During And After Bankruptcy Guidelines

In this article, we will cover and discuss mortgage during and after bankruptcy guidelines. Bankruptcy can mean many different things to different people. It does not mean homeownership is out of the picture. Many Americans file either chapter 7 or chapter 13 bankruptcies to get back on their feet. The bankruptcy laws are very straightforward and can help many families regain financial stability. In this blog, we will detail some pointers on how to qualify for a mortgage as fast as possible after declaring bankruptcy. We have written many articles on this topic as we help hundreds of families purchase or refinance homes recently out of bankruptcy or even still in an active chapter 13 bankruptcy. There are a million different reasons why families file bankruptcy, but they are all looking to obtain the same result, a fresh start.

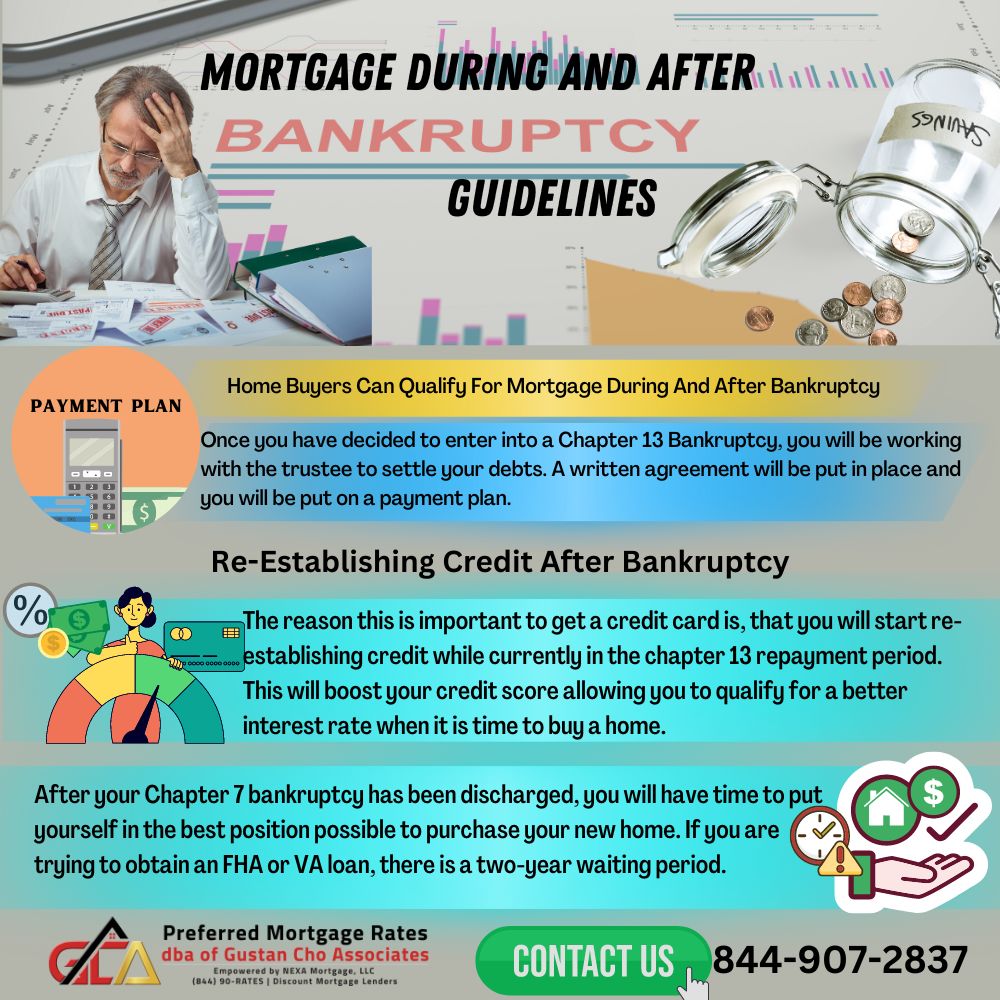

Home Buyers Can Qualify For Mortgage During And After Bankruptcy

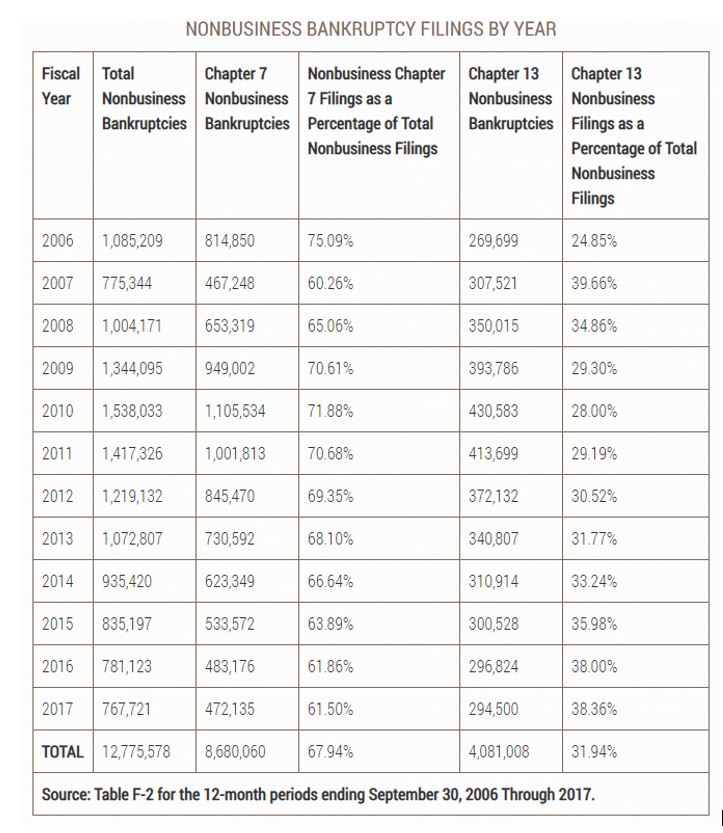

You can see from the chart below; personal bankruptcies have declined slightly from the hard economic times of 2008 to 2012. But bankruptcies are still incredibly common with over 700,000 in 2017 alone. The majority of banks and lenders will tell you need to wait a minimum of two years after your bankruptcy discharges before you qualify for a mortgage. This is not true, and this is a lender overlay. Please see our blog on LENDER OVERLAYS for more information. After 12 on-time payments to a Chapter 13 bankruptcy, you are legally allowed to enter a mortgage with the trustee’s permission. With an FHA or VA loan, you will require a manual underwrite but homeownership is closer than you think.

The Chart is from http://www.uscourts.gov/news/2018/03/07/just-facts-consumer-bankruptcy-filings-2006-2017

h

Tips In Qualifying For Mortgage During And After Bankruptcy

Once you have decided to enter into a Chapter 13 Bankruptcy, you will be working with the trustee to settle your debts. A written agreement will be put in place and you will be put on a payment plan. It is incredibly important not to miss any payments to the trustee. During the mortgage process, you will need to verify on-time payments. If your employer allows you to automatically deduct the payment to the trustee from your pay stub, we strongly recommend that. This way it is out of sight and out of mind and you cannot miss a payment. Not missing a payment to the trustee is obvious but there are a few other tips and tricks we have learned over the years to help you qualify for a mortgage as soon as possible. While in a Chapter 13 Bankruptcy, it would be a good idea to get permission from the trustee to obtain a secured credit card.

Re-Establishing Credit After Bankruptcy

The reason this is important to get a credit card is, that you will start re-establishing credit while currently in the chapter 13 repayment period. This will boost your credit score allowing you to qualify for a better interest rate when it is time to buy a home. Once you have made 12 payments to the trustee, you can start the mortgage process for a VA or FHA home loan. The Department of Housing and Urban Development oversees VA and FHA mortgages, and they allow Americans’ who are currently in a chapter 13 bankruptcy to enter into a new mortgage. As part of the approval process, you must obtain written permission from the trustee to enter into the new mortgage. One of the easiest ways to do this is to keep a mortgage payment similar to your current rental payment. The trustee is there to help you financially and they are in favor of you buying a home. As they realize this is part of the American dream.

Chapter 7 Bankruptcy Mortgage Guidelines

Since there will be mandatory waiting. After your Chapter 7 bankruptcy has been discharged, you will have time to put yourself in the best position possible to purchase your new home. If you are trying to obtain an FHA or VA loan, there is a two-year waiting period. If you are trying to obtain a conventional mortgage,there is a four-year waiting period. The waiting periods could be longer if you had a house surrendered during chapter 7. Call or text Mike Gracz on 630-659-7644 for more details when a home is included. During this two to four year waiting, it would be in your best interest to re-establish credit. It is incredibly important that you use this credit responsibly. Let’s say you get a credit card with $1,000 limit, you will want to do everything you can to keep that cards’ balance below $100. Having a tradeline with less than 10% utilization will help boost your credit scores. Any missed payments after a bankruptcy discharge can be catastrophic to your qualifications. An underwriter likes to see that you have learned your lesson through the bankruptcy and are on track to remain financially stable.

Qualifying For Mortgage During And After Bankruptcy With A Direct Lender With No Overlays

Gustan Cho Associates are experts in mortgage lending when bankruptcies are involved. We are a full-service mortgage lender without LENDER OVERLAYS! We helped hundreds of clients within an active chapter 13 bankruptcy or less than 2 years discharged from a Chapter 13 Bankruptcy. As stated above, most banks do not allow borrowers to obtain a mortgage unless they are discharged a full two years from their bankruptcy. Please check out our reviews and success stories for more information. If you have any general questions surrounding mortgages and bankruptcies, please reach out to Mike Gracz on 630-659-7644 or text us for a faster response. Or email us at mgracz@gustancho.com. Either Mike or one of his highly skilled loan officers will assist you through the mortgage process. We have seen every credit profile out there and will point you in the right direction if you do not qualify today. We work with many families for extended periods of time before they qualify for the home of their dreams. We are here to help put you on a financial plan to qualify for your dream home as soon as possible. Looking forward to hearing from you.