Foreign National Mortgage Loans

This blog will cover qualifying and getting approved for foreign national mortgage loans. Foreign National mortgage loans are real estate for resident aliens who plan on living in the United States but are not yet legal residents. All countries like investment from friendly foreign countries. After all, someone should spend their money at our Walmart than their Walmart. Then it matters a little less than their country makes the items we buy at our Walmart. At least it is our Walmart in Bolingbrook, Illinois, or Cucamonga, California. John Strange of Preferred Mortgage Rates, Inc. explains what foreign national mortgage loans are:

Foreign National Mortgage Loans are portfolio loans for expatriates who are not citizens of the United States that enable them to purchase real estate in the U.S. Foreign National Mortgage loans are for owner-occupant homes, second homes, and investment properties.

Of course, American Made is Better and more expensive, but better because it is made here. With all that said, what better investment a Foreign National can make than buying real estate in the good old USA? Of course, Toyota could open another plant in Lexington, Kentucky, employ thousands of people, and support “kick back” to University of Kentucky basketball players. That might be better unless you, the minority, still believe college is for education. In the following paragraphs, we will cover foreign national mortgage loans and lending requirements.

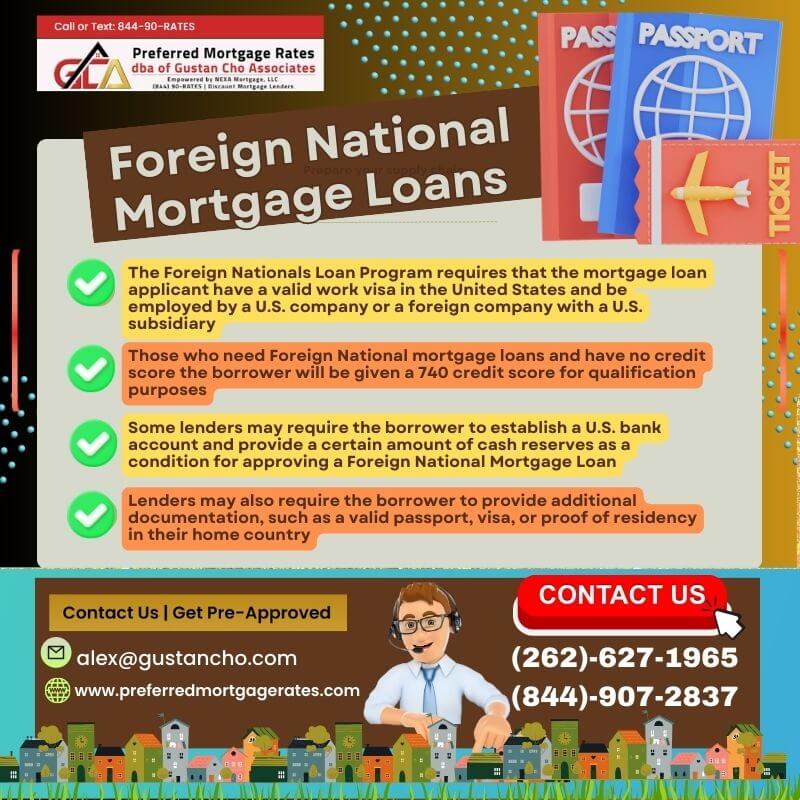

Requirements Of Foreign National Mortgage Loans

What is happening is that people who live in China are vacationing in Las Vegas, NV. They are spending money in Las Vegas, NV. They are losing money in Las Vegas, NV. Why not buy a house in Las Vegas, NV? These gamblers need to stop throwing their money away and start paying Real Estate Taxes to support education.

The reality is most foreign Nationals that are purchasing homes in the USA have substantial down payments. Foreign National Lenders have very little risk. Often the down payment requirement starts at 35% and, depending on credit, and immigration status, can be bigger.

Foreign National lenders are getting double-digit rates. The risk they have is minimal. Who walks away from a mortgage payment after putting 35% down on the purchase? How can the lender lose money? They make the foreign national buyer pay for insurance; they have so much equity in the foreign national’s purchase that, in almost any case, the foreign national lender would have a secure investment.

Investing In The United States With Foreign National Mortgage Loans

It’s also a great way for foreign nationals to establish their intent to reside and do business in the United States. You will see more and more Foreign National Lenders and Foreign National Buyers shortly. Many foreigners come to the United States to study, visit, work, or start a business. The dream of home ownership is no longer for Americans. Many people globally dream of owning a home or investing in real estate in the United States.

The team at Preferred Mortgage Rates has a national reputation for being able to approve foreign national mortgage loans other lenders cannot.

Not only is real estate investing for Americans, but many foreign nationals are jumping on the bandwagon. Commercial lenders like Lending Network, LLC, and other national commercial lenders specialize in foreign national mortgage loans. For more information about investing in properties in the United States and qualifying for foreign national mortgage loans, please contact us at Preferred Mortgage Rates at 844-90-RATEs, or text us for a faster response. Or email us at gcho@gustancho.com. The team at Preferred Mortgage Rates is available seven days a week, evenings, weekends, and holidays.